Ask AI Anything About This Video

Ready to Supercharge Your Learning Beyond this Video Summary?

Start Your Free Trial and experience turbocharged learning with our entire suite of tools and resources to accelerate the achievement of your goals!

LearnSmarter.ai can help to speed up your learning and goal achievement by:

- High-Speed Learning: Just like this video summary, all our tools are designed to help you grasp key concepts quickly, minus the fluff.

- Unlimited AI Assistance: Ask anything, anytime, and receive instant answers for deeper understanding and efficient learning. (Free plan members get only 5 queries/day)

- Ad-Free Experience: Enjoy seamless learning without the interruptions of ads.

- Fast Track Courses Access: Delve into concise, curated content from leading self-growth books, save time, and enrich your knowledge swiftly.

Try LearnSmarter.ai PLUS for 3 days, absolutely free. Pay nothing and cancel anytime if it’s not for you.

Overview of This Video

In the video titled “THE PSYCHOLOGY OF MONEY” by The Swedish Investor, you are taken on an insightful journey into the world of finance and investment. The creator skillfully breaks down complex financial concepts into easily digestible pieces, making it an excellent resource for both beginners and seasoned investors.

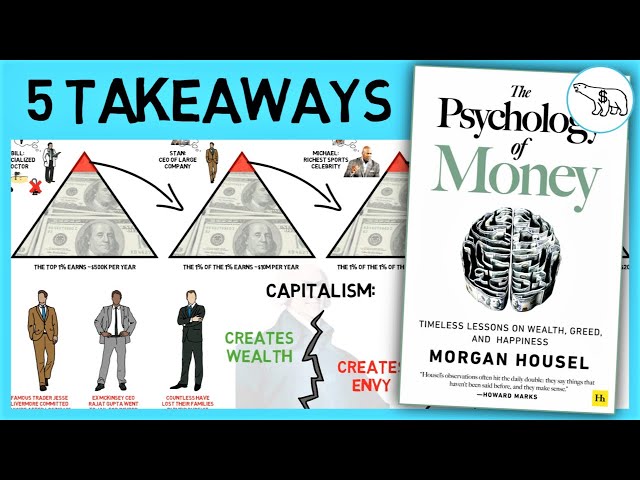

The video primarily focuses on the key takeaways from Morgan Housel’s book, “The Psychology of Money”. It emphasizes the importance of understanding your financial behavior and how it can significantly impact your financial success. The main topics covered include the necessity of enduring market volatility for high returns, the pitfalls of envy and social comparison, the role of personal perspective in financial decisions, the unpredictability of financial disasters, and the deceptive allure of pessimism in investment advice.

By watching this video, you can gain a deeper understanding of the psychological aspects of money management and investment. It encourages you to reflect on your financial behaviors and decisions, helping you to make more informed and rational choices in the future. The video also underscores the importance of preparing for financial uncertainties and the value of maintaining a balanced perspective on financial matters.

Whether you’re just starting your investment journey or looking to enhance your financial literacy, this video offers valuable insights that can help you navigate the complex world of finance with greater confidence and understanding.

Key Takeaways

- Enduring Volatility for High Returns: Investing comes with a price, and that price is volatility. High returns in the stock market over the long term often come with periods of significant volatility. If you can’t stomach a decrease in your net worth during these periods, you may need to adjust your investment strategy.

- The Dangers of Envy and Comparison: Capitalism is excellent at generating wealth and envy. The urge to surpass your peers can lead to unwise financial decisions. It’s essential to recognize when you’ve achieved financial success and resist the urge to risk what you have for what you don’t need.

- The Influence of Perspective on Financial Decisions: People’s financial decisions are heavily influenced by their backgrounds, experiences, and values. What seems irrational to one person might make perfect sense to another. Recognizing this can help you avoid copying an investment strategy that doesn’t align with your goals.

- The Unpredictability of Financial Disasters: Major financial disasters are often impossible to predict. Instead of trying to foresee these events, it’s more beneficial to prepare yourself mentally and financially to weather them when they occur.

- The Allure of Pessimism in Investment Advice: Pessimistic investment advice can seem more appealing due to our survival instincts and the fact that setbacks often happen faster than progress. However, it’s important to maintain a balanced perspective and not let pessimism unduly influence your investment decisions.

Why people join LearnSmarter.ai PLUS

“I am always seeking new ways to grow and develop. When I signed up for LearnSmarter.ai PLUS, I was blown away. The AI goal setting app helped me define my ambitions clearly with step-by-step action plan, while the various AI tools saved me time, enhanced my understanding and critical thinking. Furthermore, the Fast Track Courses provided me a quick way to learn top self-growth books easier. It’s been a game-changer for my personal and professional growth.”

Video Review

“The Psychology of Money” by The Swedish Investor is a must-watch for anyone interested in understanding the less-discussed, psychological aspects of finance and investment. The video’s strength lies in its simplicity and clarity, making complex financial concepts accessible to viewers of all levels of financial literacy.

The creator does an excellent job of distilling key insights from Morgan Housel’s book into digestible takeaways. The emphasis on behavior and perspective in financial success is a refreshing change from the usual focus on technical strategies and market trends.

However, while the video provides valuable insights, it could benefit from more real-life examples to illustrate the points being made. The use of hypothetical scenarios, while effective, might not resonate as strongly with viewers as real-world case studies.

The video’s discussion on the unpredictability of financial disasters is particularly timely and valuable, reminding viewers of the importance of preparation over prediction. However, it would have been beneficial to provide more practical tips on how viewers can mentally and financially prepare for such events.

Overall, this video is a valuable resource for anyone looking to enhance their financial literacy and gain a deeper understanding of the psychological aspects of money management and investment. Despite its minor shortcomings, it offers a unique perspective on finance that is both enlightening and engaging.

Additional Resources

Looking for more insights and learning opportunities? Explore these related resources:

- AI Goal Setting App: Guide you in identifying your SMART goals clearer and creating an easy-to-follow action plan.

- AI Book Recommendations: Discover your next best self-growth books – a smart AI tool that personalize a list of books according to your personal interests and learning goals.

- AI Life Coach: Helps to guide and motivate you towards your personal growth goals, just like a personal coach would, but with added accessibility and convenience.

- Personal Development Courses: A series of condensed and structured courses derived from top self-growth books, designed to accelerate your learning and understanding in a time-efficient manner.

Try LearnSmarter.ai PLUS For Free

Experience limitless learning with LearnSmarter.ai PLUS. Try our Zero-Risk, 3-Day Free Trial and access all our tools ad-free. Cancel anytime, no charges. Turbocharge your growth and goals now!